By Tom Westbrook

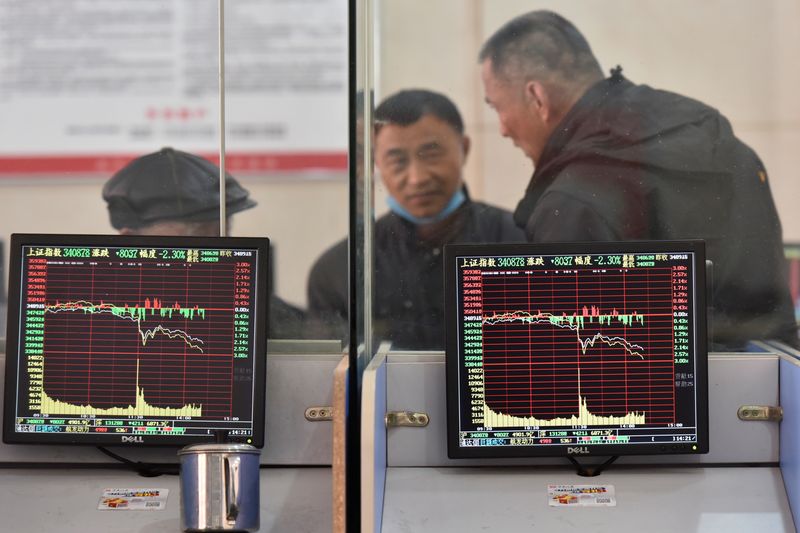

SINGAPORE (Reuters) – Promises of policy support and a possible meeting between tech giants and China’s leaders this week have helped stem a rout in the country’s stock markets for now, but investors expect it is unlikely to attract new inflows until the economy stabilises.

Mainland and Hong Kong equities have dramatically underperformed global peers in the last few years as trade tensions, regulatory crackdowns, the pandemic and now fresh COVID-19 lockdowns have hurt confidence and company earnings.

Moreover, the once-mighty property sector has been in contraction, cut adrift from credit since major developer Evergrande defaulted on bond payments last year.

Hopes are focused on vague promises of help – last week from the powerful Politburo and in March from Vice Premier Liu He – as well as a chance that a high-level meeting could signal an end to a long crackdown on the internet sector.

“There is a lot of potential upside here,” said Mohammed Apabhai, Citibank’s Asia-Pacific trading strategist in Hong Kong, who said investors now seem inclined to buy dips as they wait for supportive rhetoric to turn in to action.

“Positioning is so light … that it doesn’t take very much for this market to be able to put together a fairly substantial move,” he added.

Talks between tech firms and Chinese leaders, reportedly set for Friday, are one source of guarded optimism, even if that may not trigger an immediate rush back to the heavily-sold sector.

Food delivery giant Meituan was among those invited, one person said, while the South China Morning Post reported last week that Alibaba (NYSE:BABA), Tencent and TikTok owner ByteDance had also been invited.

“Investors have been extremely fearful of China’s internet regulations, leading to indiscriminate selling,” said Jian Shi Cortesi, investment director for China and Asian equities at GAM Investments.

“Rather than specific actions, investors probably want to see less actions in terms of internet regulation (and) may need some time to regain confidence.”

In just over a year the tech-heavy MSCI China index has nearly halved, compared with a 2% rise in world stocks and a 10% rise for the S&P 500.

REPRIEVE OR RE-RATE?

China’s near-term economic outlook is bleak as lockdowns in some of its biggest cities look set to drag well into May.

Factory activity shrunk for a second straight month in April and at its steepest pace in two years as anti-virus measures disrupted production and supply chains, while services activity plunged as hundreds of millions of people were ordered to stay home.

But China’s policymakers have been cautious in rolling out fresh stimulus. If workers are stuck at home and factories can’t get their goods to market, traditional policy stimulus tools such as interest rate cuts or liquidity injections may have only limited impact, analysts noted.

“We still believe markets should remain focused on the development of the pandemic and the corresponding zero-COVID strategy,” said Nomura economists, who noted precipitous declines in travel and spending over the Labour Day holiday.

“All other polices are of secondary importance,” they wrote.

The depth of global investors’ nerves – particularly since sanctions on Russia highlighted existential risks in investing abroad – is also holding back capital.

“We think the regulatory easing is just a reprieve and not a permanent change in policy,” said Brian Jacobsen, senior investment strategist at Allspring Global Investments.

“After they get the economic engine revving again (authorities) could once again impose restrictions on businesses. We think Chinese equities are attractively priced, but there are some unattractive risks.”

Still, the past few weeks have given some money managers enough hope to begin dipping their toes in again.

“It depends on your risk appetite,” said George Boubouras at K2 Asset Management in Melbourne.

“Our Asian fund did not hold a large China stock position since mid 2021 due to the mixed messages coming out of Beijing.

“However, over the past month, with the new lows, we have started to build positions from a low base.”

Source : Reuters