By Gina Lee

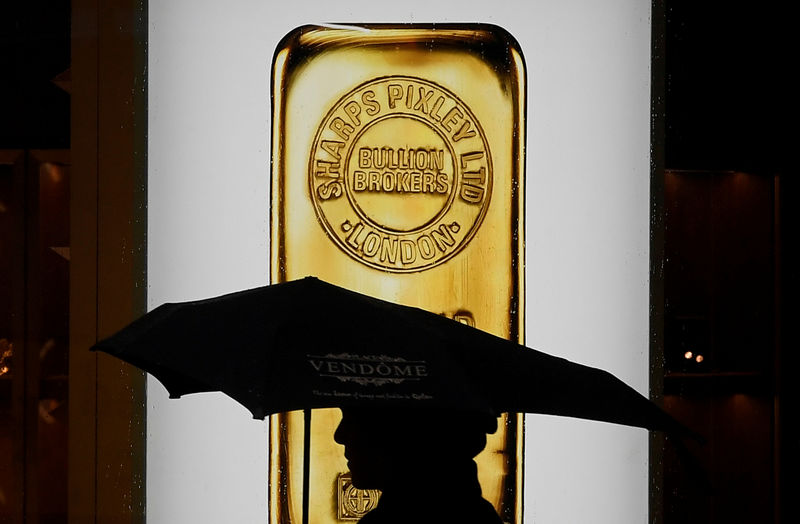

Investing.com – Gold was down on Wednesday morning in Asia, hitting a more than one-week low. The dollar remained near recent highs and U.S. Treasury yields continued to weigh on demand.

Gold futures fell 0.73% to $1,944.70 by 1:07 AM ET (5:07 AM GMT), after hitting their lowest levels since Apr. 11. The dollar, which normally moves inversely to gold, was down on Wednesday but remained near recent highs.

The yellow metal came close to climbing above the $2,000 mark on Monday, as the war in Ukraine precipitated by the Russian invasion of Feb. 24 and worries about rising inflation drove investors towards the safe-haven asset.

Prices fell up to 1.8% on Tuesday thanks to a strengthening dollar and rising Treasury yields that overshadowed inflows into bullion.

“With the U.S. dollar still firm today, and with China declining to lower its 1 and 5-year loan prime rates, it looks like the long squeeze in gold is continuing in Asia,” OANDA senior analyst Jeffrey Halley told Reuters.

In an unexpected move, the People’s Bank of China kept its loan prime rates (LPRs) steady earlier in the day. The one-year LPR was at 3.7% and the five-year LPR at 4.6%.

U.S. Treasury yields also continued to climb towards multi-year highs, with investors bracing for the U.S. Federal Reserve to hike its interest rates aggressively in the coming months.

Recent gains show Ukraine is still a key focus, with the move overnight about rebalancing fast money flows and not a structural change in gold’s outlook, said Halley. However, a sustained rise by U.S. 10-year yields through 3% could change that outlook, he added.

In other precious metals, silver fell 0.6% and platinum eased 1.3% to $977.93, while palladium was up 0.4%.

Source : Investing.com