During early trading, Adani Enterprises, the flagship firm of the group, observed a nearly 4% decline, dropping to an intra-day low of Rs 2,976.05. Similarly, Adani Ports and Special Economic Zone experienced a decrease of more than 3%, falling to Rs 1,227.25.

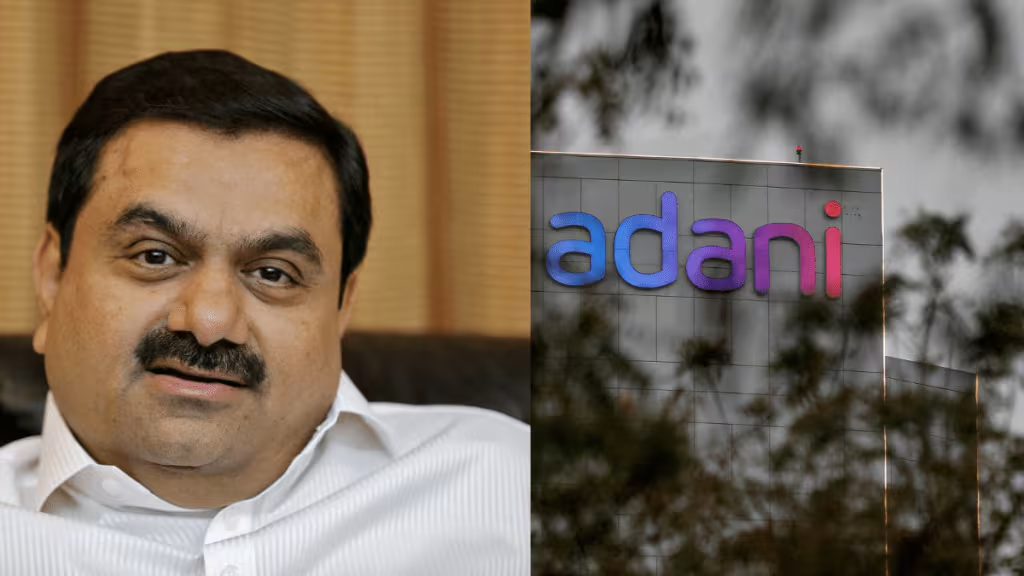

Shares of companies Adani Group experienced a decline of up to 2-4% on Monday following a report by Bloomberg that indicated that the US government may have expanded scope of investigation.

Adani Enterprises, the flagship firm of the group, witnessed a nearly 4% drop to an intra-day low of Rs 2,976.05 during early trading, while Adani Ports and Special Economic Zone saw a decrease of over 3% to Rs 1,227.25.

Similarly, Adani Power, Adani Green Energy, and Adani Energy Solutions registered losses ranging between 2% and 3%.

According to Bloomberg’s article on Friday, the U.S. government is scrutinizing the actions of founder and Chairman Gautam Adani, as well as investigating potential involvement of Adani entities or affiliates in bribing Indian officials to gain favorable treatment in energy projects.

The investigation is being handled by the U.S. Attorney’s office for the Eastern District of New York and the Department of Justice’s fraud unit. Additionally, the probe extends to Indian renewable energy company Azure Power.

In response to the report, Adani stated it was unaware of any investigation against the firm or its founder.

This development comes more than a year after a report by short seller Hindenburg Research leveled accusations of fraud and market manipulation against Adani.

Despite the denial of these allegations by the conglomerate and its recent clearance by India’s securities regulator, the Bloomberg report reignited concerns.

While the Hindenburg report initially led to significant losses exceeding $100 billion in Adani shares, the stock had since rebounded and even surpassed pre-report levels.

Nevertheless, data from Monday indicated that Adani’s dollar-denominated bonds experienced substantial losses following the Bloomberg report, as it raised issues similar to those highlighted in the Hindenburg note.

(With Agency Inputs)

Source:financialexpress.com