Below-par monsoon’s impact to be biggest on FMCG products, 2Ws

By Viveat Susan Pinto, Swaraj Baggonkar & Bindu D. Menon

The monsoon rains this season have been below-normal and unevenly spread, threatening a rural recovery that had begun over the last few months. The only comfort is urban demand is stable for now, said top executives at key fast-moving consumer goods (FMCG) companies and automotive firms. However, most are keeping a close watch on inflation, notably, food inflation.

“The kharif crop might get impacted even if the sowing is good,” Nestle India’s chairman and MD Suresh Narayanan recently said about the monsoon deficit in August.

Narayanan added that food inflation needs to be watched carefully since it is a cause for concern. If the monsoon is weak (in September), rural demand will be impacted. “At the moment, demand looks stable,” he said about the overall monsoon impact on the FMCG sector.

The deficit in the southwest monsoon rainfall between June 1 and August 30 expanded to 9% of the long-period average (LPA), the India Meteorological Department (IMD) said last week, adding that rainfall in September would be ‘normal’ after the driest August in over a century. The September precipitation, however, may not be enough to wipe-out the overall deficiency in rainfall this season, IMD said, with the monsoons this year likely to be ‘below normal’.

This see-saw in rainfall patterns hardly bodes well for rural-dependent sectors such as FMCG and auto, which derive over a third of their sales (FMCG) and over 50% of two-wheeler sales as well as about 40% of passenger car sales from rural areas. Tractor sales are 100% from rural areas.

“Dealers are placing orders for 2-3 months forward in anticipation of good demand. But shortage of rainfall will further dampen the chances of demand revival in rural markets,” Manish Raj Singhania, president, Federation of Automobile Dealers Association, said.

Mayank Shah, senior category head at Parle Products, the country’s largest biscuit maker, admits the evolving monsoon situation is a concern for companies. The company sells 1.2 million biscuits annually, over 40% of which is in rural areas.

“The good part is that urban demand is stable. So that provides relief that at least one side of the business remains largely unaffected for now. As far as rural is concerned, yes, it is a critical situation. If the rainfall remains uneven and deficient over the next couple of weeks, it will hamper rural demand,” he said.

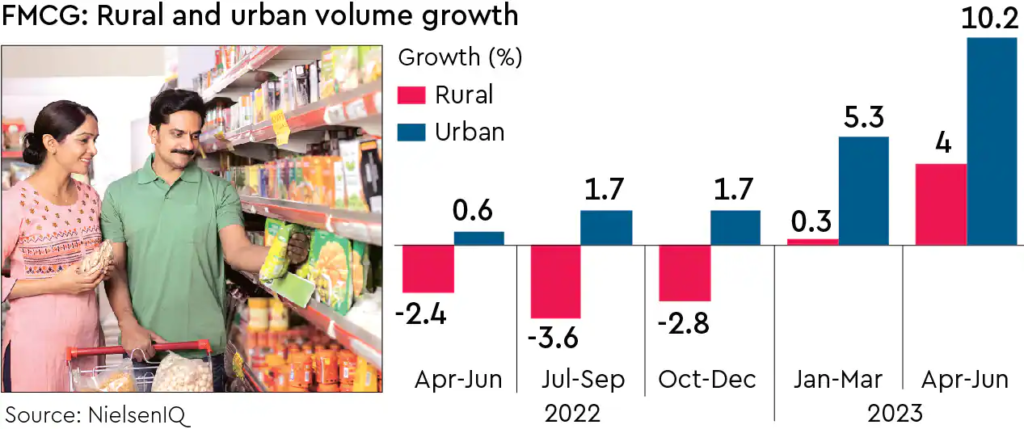

Market research agency NielsenIQ had said in August that the FMCG market saw its highest volume growth in eight quarters at 7.5%, led by a rural revival and softening commodity inflation. Rural volume growth, the research agency said, touched 4% in the June quarter, versus 0.3% reported in the March quarter and a volume decline seen in the previous three quarters. NielsenIQ said it saw spending in retail channels growing as a result of the rural recovery in the June quarter. But some CEOs caution that going into the festive season, there could be a cutback in spends as rural consumers deal with monsoon uncertainty.

“Agriculture does undergo stress if monsoons are not timely and adequate,” says Jayen Mehta, MD, Gujarat Co-operative Milk Marketing Federation (GCMMF), which makes the Amul brand of dairy products. “Food is an essential expenditure for households. That may not suffer to the extent that non-food items would. The government is also taking steps to rein in food inflation. At a broader level, though, the monsoon scenario is a key monitorable for firms,” Mehta said.

While two-wheeler volumes in August will be better than the August last year, they will still be falling short of pre-Covid-19 volumes. The Centre-controlled Vahan estimates suggest that the BS-6 two-wheeler segment will close with volumes of 1.14 million units in August, which, though higher than the same month last year, will still be lower than the 1.33 million clocked in August 2019.

Amit Goel, co-founder and chief global strategist, Pace 360, a financial services and asset management firm said, “The regions with either significantly deficient or excessive rains account for about 25% of the tractor and two-wheeler sales of the country. Besides, the most important months for tractor sales are now behind us.”

So far, rainfall deficiency has had no impact on tractor volumes. In August, retail volumes of agricultural tractors are expected to be 15% higher than same month of last year, as per Vahan.

Hemant Sikka, president, farm equipment sector, Mahindra & Mahindra, said, “Overall, the kharif sowing has progressed well except for pulses. Supported by several other key drivers like robust government support for agricultural and rural growth, increase in minimum support prices, and favourable terms of trade for farmers, we maintain an outlook of low single-digit growth.”

Source:financialexpress.com