“More the struggle undertaken by people in resolving their grievances, more unlikely it becomes that they would attempt digital payments in future,” Das said, adding that prompt reconciliation of transactions by PSOs is an easy and expeditious method of addressing customer grievances.

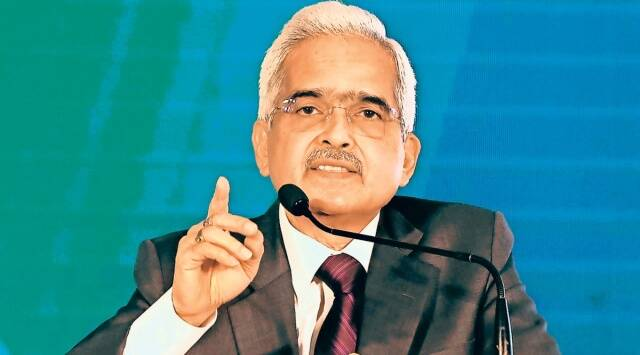

Reserve Bank of India Governor Shaktikanta Das Saturday urged payment system operators to focus on ensuring good governance, prudent risk management and responsive grievance redress mechanism.

Das asked PSOs to work on formation of self-regulatory organisations (SROs) for the greater good of all stakeholders.

“For long term success, the PSOs should specifically focus on ensuring good governance and prudent risk management; maintaining robust IT infrastructure with cyber resilience; and putting in place responsive grievance redress mechanism,” Das said, while addressing the Payment System Operators (PSO) Conference in Kochi.

“Every failed transaction, every fraud attempted or actually carried out, every complaint that is not satisfactorily addressed should be a cause of concern and must invite a detailed root cause analysis,” he said.

According to the Governor, availability and affordability of an expeditious grievance redress mechanism is of utmost importance to ensure public trust in digital payments.

While the traditional bank branch model offers a physical place where customers can lodge their grievances, the same may not be the case in digital payments where users sometimes find it difficult to ascertain the appropriate forum for lodging their grievances, he said.

“More the struggle undertaken by people in resolving their grievances, more unlikely it becomes that they would attempt digital payments in future,” Das said, adding that prompt reconciliation of transactions by PSOs is an easy and expeditious method of addressing customer grievances.

He asked PSOs to enable the RBI’s online dispute resolution (ODR) system to enhance customer satisfaction.

Das said since increase in digital payments and its users brings to the fore potential risks pertaining to cyber security, data privacy and operational resilience, PSOs should always be cognisant of the emerging threats and put in place suitable risk mitigation measures.

As payment system operations are heavily dependent on technology, many new-age tech firms are entering the payments ecosystem. Some of them have come under the regulatory ambit of the RBI for the first time. At times, some PSOs display unwillingness to comply with regulatory instructions, citing various reasons like cost of carrying out system-level changes, he said.

Das said in this digital age, there is a necessity to constantly upgrade the systems so as to remain relevant and increase efficiency. Legacy systems must be updated to bring them in line with changing realities.

“While any system may be presumed to be resilient and safe, a single bad experience of the customer with digital payments may drive him away to other channels or modes of payments. PSOs have a big responsibility here,” the Governor noted.

Speaking on the Unified Payments Interface (UPI), he said the platform has revolutionised the payments ecosystem with about 803 crore transactions worth Rs 13 lakh crore processed in January 2023 alone.

Source:indianexpress.com