On the plus side, India achieved a record-breaking export value in the same quarter thanks to Apple and Samsung. Check details here.

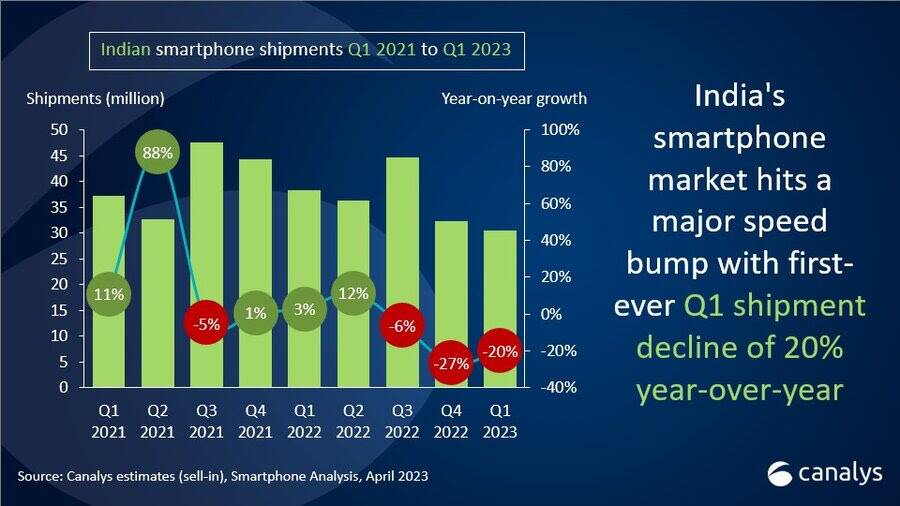

The Indian smartphone market, which has over 600 million users, witnessed a historic slump in the first quarter of 2023. According to research firm Canalys, smartphone shipments in India dropped by 20% year-on-year, the first-ever Q1 decline.

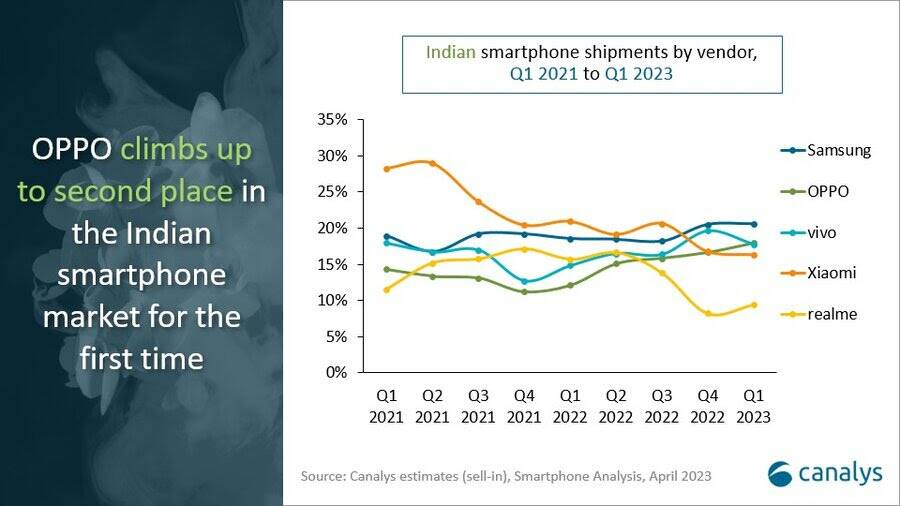

This was due to various factors such as weak consumer demand, high inflation, inventory correction and component shortage. Samsung, which had overtaken Xiaomi in Q4 2022, retained its top spot in Q1 2023 with a 21% market share and 6.3 million units in shipments.

Meanwhile, Xiaomi slipped down even further to fourth place with 5 million shipments. It’s been overtaken by Oppo, which driven by successful new product launches now stands second with 5.5 million shipments. Vivo came in third with 5.4 million shipments.

Canalys asserts that while the Indian market is facing early-year struggles, vendors continue to remain bullish on long-term prospects, and are therefore continuing to “fuel” the market. This is being achieved by optimising retail, local sourcing, manufacturing, and research and development.

“Vendors with efficient channel management have proven to be more resilient to market volatility. Post-pandemic, vendors who have nurtured mainline retail channels, have demonstrated stability even during market downturns. Increasing contributions from high-price-band models have encouraged vendors to focus on strengthening their offline channels,” said Sanyam Chaurasia, an analyst at Canalys.

Samsung has been successful in making a dent in the offline market with its new 5G-powered A-series smartphones, according to Canalys. Meanwhile, Apple with its new offline stores will “further enhance its brand experience and position.” These two companies have also played a crucial role in driving India’s smartphone export growth, helping achieve a record-breaking export value of almost $4 billion in 2023’s first quarter.

“As disposable income gradually rises, consumers are willing to spend more on premium devices. To succeed in this segment, brands must prioritise availability, affordability and aspirational value. Going forward, brands should also emphasise export strategy to align with the government’s initiatives,” adds Chaurasia.

Global smartphone market isn’t performing too well either

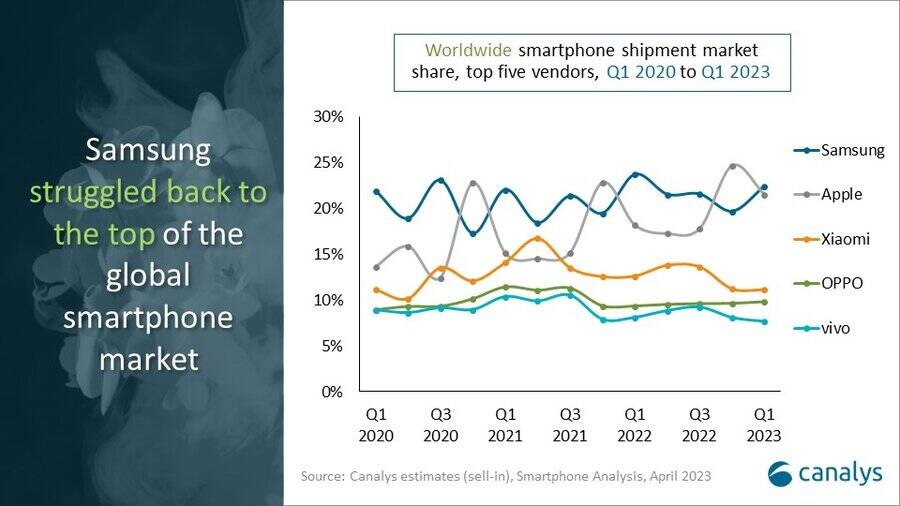

Meanwhile, the Canalys report for the global smartphone market also revealed worrying trends, with the market keeping up its decline in the first quarter of 2023, dropping by 12% compared to the same period last year. This was the fifth quarter in a row that the market shrunk, as various factors such as low consumer confidence, rising prices, excess inventory, and supply chain disruptions affected the industry.

Samsung was the only major vendor to bounce back from the previous quarter and reclaimed the top spot with a 22% share of the market. Apple came in second with a 21% share, followed by Xiaomi, Oppo and Vivo. However, the market also showed some signs of recovery, as demand improved for certain products and vendors became more proactive in production planning and innovation.

Source:indianexpress.com