By Ambar Warrick

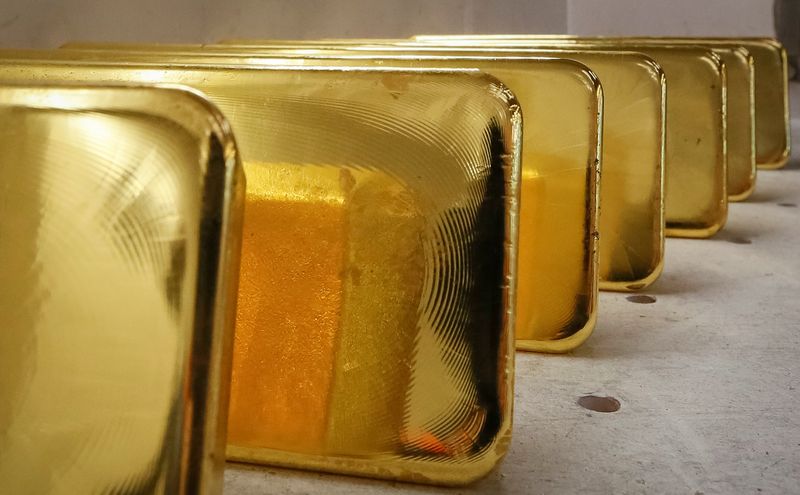

Investing.com– Gold prices edged higher on Thursday, with most other precious metals marking small gains after a rally in the U.S. dollar appeared to have paused.

As of 2056 PM ET (0057 GMT), spot gold was trading 0.1% higher at $1,767.41 an ounce. Gold futures fared better, up 0.4% at $1,783.60 an ounce.

Platinum futures rose 0.1%, while Silver futures added 0.6% after plummeting 1% over the past two days.

Gains in precious metal prices came as the U.S. dollar cooled after a two-day rally. The dollar index surged nearly 1% in the past two days after hawkish comments from two Federal Reserve members drove up expectations of sharper interest rate hikes this year.

San Francisco Fed President Mary Daly and Chicago Fed President Charles Evans both signaled that inflation is yet to cool in the country, and the Fed was likely to raise rates even further to combat rising prices.

A potential escalation in U.S.-China tensions had also driven safe haven demand for the greenback.

The U.S. Dollar Index was trading down 0.1% in Asian trade on Thursday. U.S. Dollar Index Futures fell in a similar range.

While gold appears to have gained some ground in the past two weeks, the outlook for the yellow metal is dulled by the prospect of rising interest rates this year. Most other precious metals are also expected to see muted price action as the Federal Reserve continues to tighten monetary policy.

In industrial metals, Copper futures sank 0.2% to $3.4710 a pound. Zinc futures dropped 0.8%, while Nickel futures rose marginally.

Copper prices dropped sharply this week following a swathe of weak manufacturing PMIs from across the globe. This trend of weakening factory data is expected to weigh on industrial metals in the coming months.

Source:investing.com