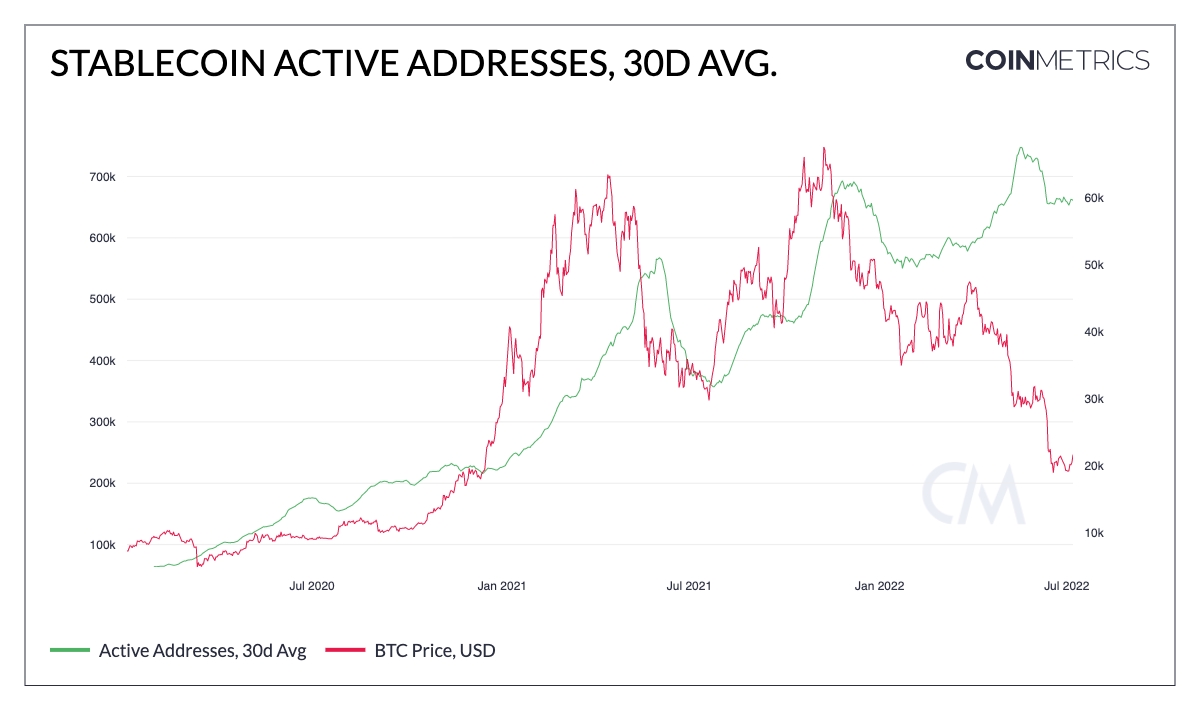

Following the collapse of Terra and the subsequent crypto crash, stablecoin active addresses surged to a new all-time high. Meanwhile, bitcoin (BTC) and ethereum (ETH) active addresses have plunged drastically during this period.

According to a recent report by crypto intelligence firm Coin Metrics, stablecoin active addresses hit a new all-time high in May 2022, peaking at over 748,000 on May 18. This number has remained at over 650,000 since then, per the analysts.

This was not entirely unexpected as many investors exchange their cryptoassets into stablecoins during market crashes and times of extreme uncertainty.

Notably, the majority of the stablecoin active address growth came from tether (USDT), the most popular stablecoin, issued on the Tron (TRX) blockchain. On the other hand, an activity involving USDT issued on the Ethereum blockchain has fallen in 2022.

Aside from USDT, other stablecoins also saw a surge in daily active addresses. For one, USD coin (USDC), the second most popular stablecoin, daily active addresses hit their highest levels (over 34,000) in more than a year this past May.

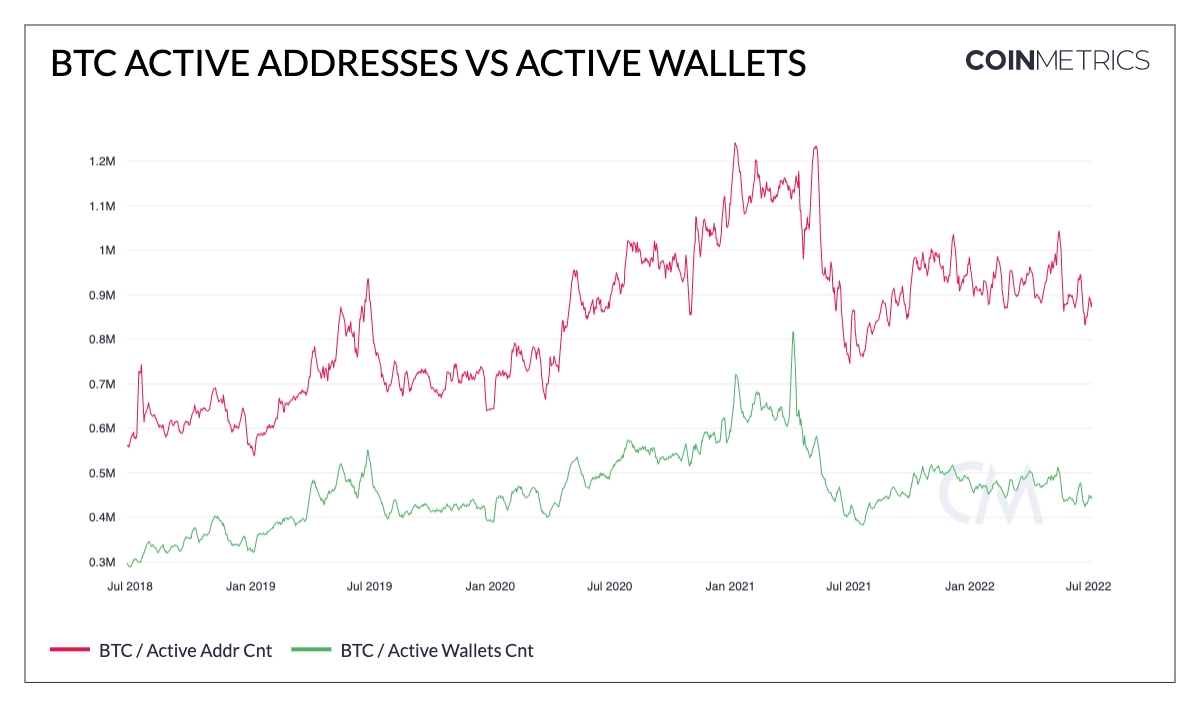

In contrast, BTC and ETH active addresses have dropped following the implosion of Terra. Monthly BTC active addresses, which peaked at a little over 22.1m in mid-January last year, have dropped to below 16m.

Moreover, the number of daily active BTC wallets, a group of addresses that are likely owned by the same individual or entity, has dropped to almost July 2021 lows. As individual wallets are often composed of multiple addresses, the drop in the number of wallets better measures the amount of actual unique users.

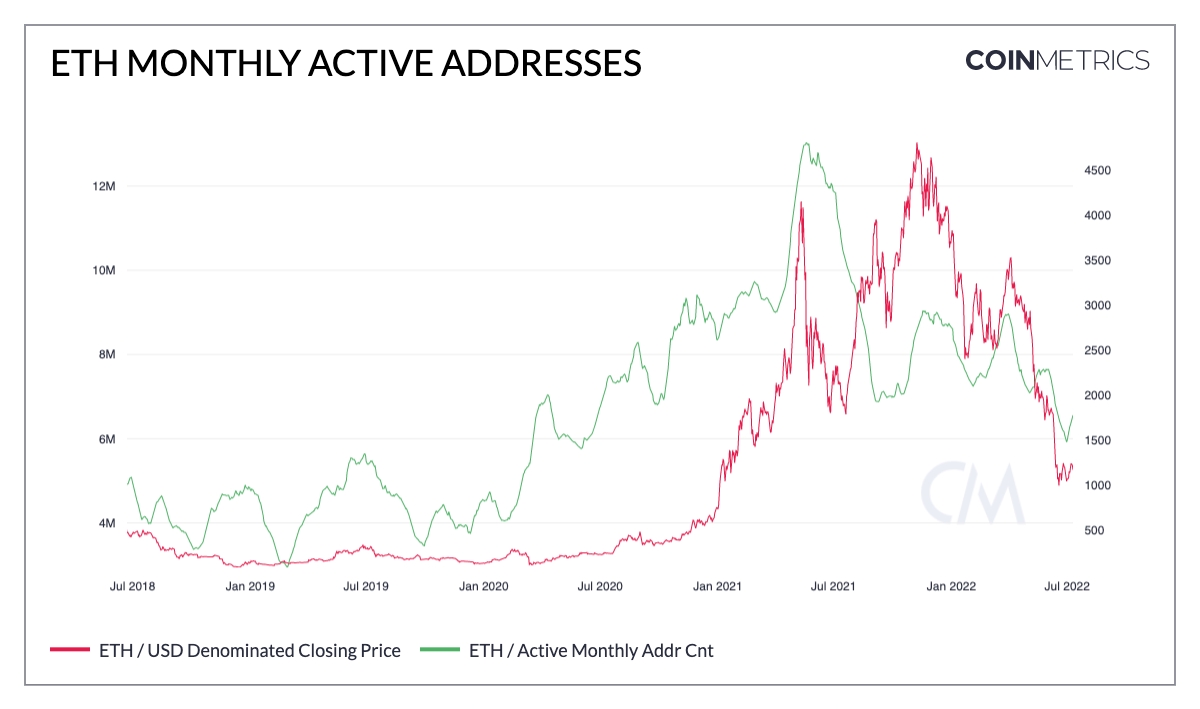

The second-largest cryptoasset, ETH, has seen even a greater drop in the number of monthly unique active addresses. The number topped at 13m on May 19, 2021, but has currently dropped to just over 6m.

“ETH active addresses tend to be correlated with ERC-20 [an Ethereum token standard] transactions,” the report said, noting that the DeFi activity overall has considerably dropped following the collapse of Terra and the recent crypto meltdown.

Source:cryptonews.com