By Zhang Mengying

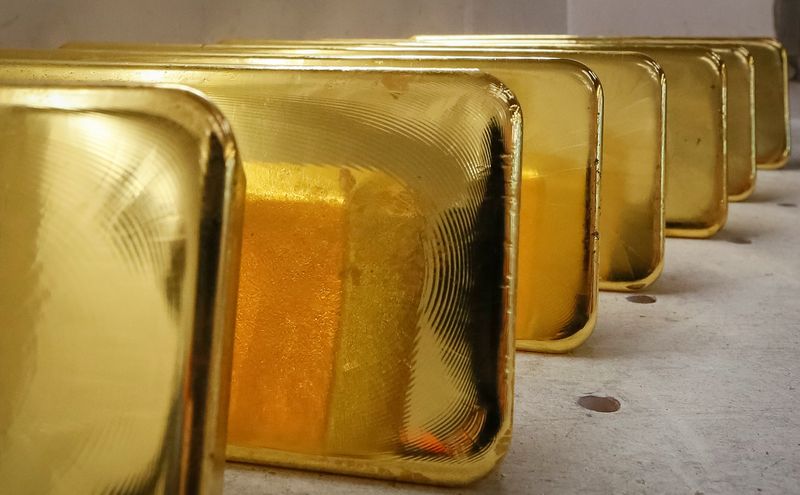

Investing.com – Gold was down on Friday morning in Asia as U.S. Treasury yields rose, with investors looking to U.S. inflation data for more clues on the interest rate hikes path of the U.S. Federal Reserve.

Gold futures were down 0.32% to $1,846.85 by 11:20 PM ET (3:20 AM GMT). The dollar, which normally moves inversely to gold, inched down on Thursday morning.

Benchmark U.S. 10-year Treasury yields edged up, denting demand for zero-yield gold.

The European Central Bank (ECB) announced on Thursday that it will prepare a quarter-point interest rate hike in July and suggested a bigger hike in the fall over long-lasting high inflation. The inflation in the eurozone now exceeds 8%. The ECB also said that it will end net asset purchases on July 1, 2022.

Now investors shifted their focus to the U.S. consumer price index (CPI) and assess how aggressive the interest rate hikes from the Fed would be.

U.S. initial jobless claims increased to the highest level in nearly five months last week, suggesting that the job market remained tight.

In Asia Pacific, China’s factory factory-gate inflation cooled to its slowest pace in 14 months in May. Official data released earlier in the day showed that the producer price index (PPI) rose 6.4% year-on-year in May, while a rise of 8.0% was recorded in April.

In other precious metals, silver fell 0.74%. Platinum was down 0.45%, and palladium gained 0.5%.

Source:investing.com