Binance coin (BNB), the native token of the world’s largest crypto exchange Binance, has extended losses as new regulatory scrutiny and media investigation have once again put the exchange in the spotlight – albeit not in a positive manner.

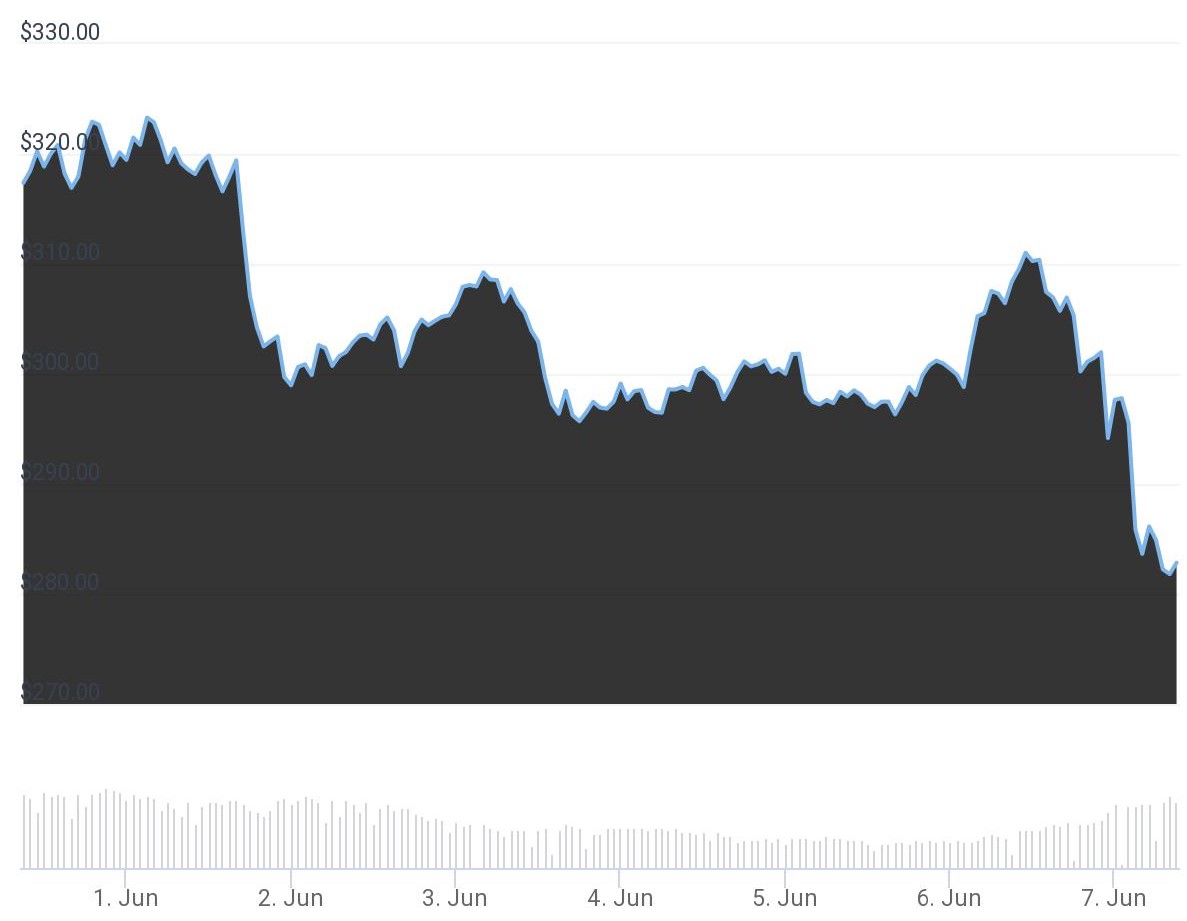

At 7:10 UTC on Tuesday morning, BNB is changing hands at USD 282.7, down by 9.1% over the past 24 hours. The coin is down by 12.2% over the past week and by nearly 60% from its all-time high of USD 686 recorded in May 2021, according to CoinGecko.

Notably, the entire crypto market is in the red today, though BNB is one of the worst-hit among the top 100 coins by market capitalization.

Meanwhile, the coin stretched losses after reports emerged claiming that the US regulators are investigating whether Binance broke securities rules by selling digital tokens during an initial coin offering (ICO) back in 2017.

According to a report by Bloomberg, citing people familiar with the matter, the US Securities and Exchange Commission (SEC) is probing the origin of the BNB token, which is now the world’s fifth-biggest crypto with a market capitalization of over USD 46.19bn. Investigators are examining whether the launch should have been registered with the agency.

The report also claimed that Binance “faces multiple investigations in Washington,” adding that the SEC is looking at market-making companies tied to CEO Changpeng Zhao (CZ).

“The SEC has expressed interest in Zhao’s ownership stakes of market makers on Binance.US and whether the exchange has conducted broker-dealer activities,” Bloomberg reported, citing a person with direct knowledge of the review.

In a statement, Binance has reportedly said that “it would not be appropriate for us to comment on our ongoing conversations with regulators, which include education, assistance, and voluntary responses to information requests.”

To make things even worse for Binance, a “special report” by Reuters has accused the crypto exchange of serving as a conduit for laundering at least USD 2.3bn worth of illicit funds during the period between 2017 and 2021.

The news agency alleged that Binance processed transactions from hacks, frauds, and illegal drug sales for five years, with Reuters claiming that it worked with blockchain analytics firms Chainalysis and Crystal Blockchain to track funds, while also examining court records and statements from law enforcement.

Addressing the report, Binance shared its email exchange with Reuters reporters and said that the report is “rife with falsehoods” and relies on poor data.

“We highly suggest you ignore those authors and pundits who cherry pick data, rely on conveniently unverifiable “leaks” from regulators, and feed into the cult of crypto paranoia for fame or financial gain,” Binance said.

Source:cryptonews.com