Grayscale Investments is pushing to convert the world’s largest publicly traded bitcoin fund into an ETF as a July 6 deadline looms for the Securities and Exchange Commission (SEC) to accept or reject its application.

Why it matters: The Bitcoin Trust, often referred to by its ticker symbol GBTC, recently traded at a record discount to its net asset value. In layman’s speak: It has declined more than the price of bitcoin. Grayscale says that converting the fund to an ETF will close that gap.

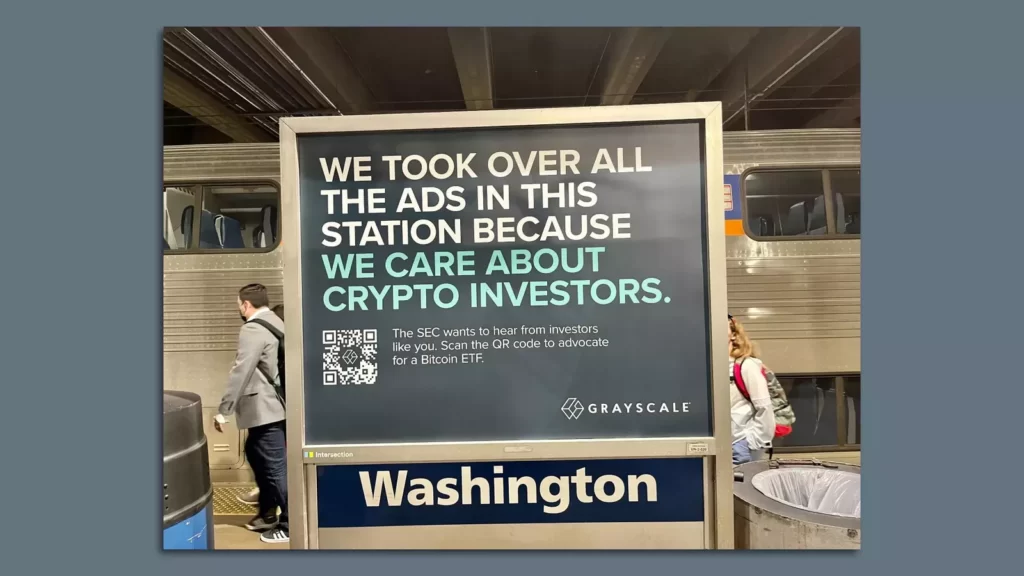

Driving the news: Grayscale papered over Washington, D.C.’s, Union Station with one message: “We care about crypto investors.”

- Firm CEO Michael Sonnenshein has previously threatened to sue the regulator in the event of a rejection, asserting that the SEC was doing investors a disservice by not approving a fund that is a more direct bet on bitcoin.

What they’re saying: “Our priority will always be advocating for investors, and this campaign embodies that commitment,” Sonnenshein tells Axios.

- “We designed an out-of-home campaign to make it even easier for investors to share their thoughts on if there should be a spot bitcoin ETF in the United States,” he said.

Yes, but: You can just own bitcoin outright.

Source:axios.com