By Tom Kool

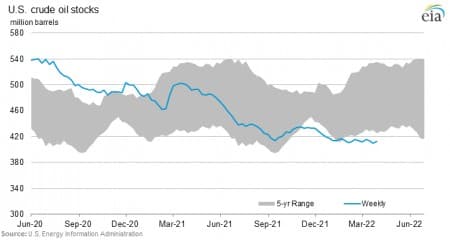

Oil prices remained fairly stable this week, with ICE Brent balancing slightly above the $100 per barrel mark. Fears of Russian supply disruptions were temporarily put on the back burner by the vast IEA-coordinated inventory release that greatly helped in flattening out the futures curves of all three key crude benchmarks. The extensions of COVID lockdowns in China, especially in Shanghai, have also helped the bearish cause, however it remains to be seen how long will it take for disruption fears to resurface again.

Oilprice Alert: Our trading specialists have just released a special report on how to play today’s boom in oil prices. The current run up in commodity prices has created a generational opportunity in the energy markets. Join Global Energy Alert today and receive our 20-page research report ”5 Ways To Play The 2022 Oil Boom”

IEA to Release 60 Million Barrels of Strategic Stocks. Above and beyond the US’ 180-million-barrel stock draw, IEA countries agreed to release 60 million barrels over the upcoming six months, with Japan taking a prime role amidst the relatively timid commitments of others, pledging to release 15 million barrels.

EU to Ban Russian Coal, with Delay. According to media reports, the European Union’s approval of a ban on Russian coal imports would take full effect from mid-August, following internal lobbying from Germany to extend the deadline as far out as possible to allow usual buying in the four-month wind-down period.

Chile Sues Mining Giants over Atacama Water Use. The government of Chile is suing mining majors BHP (NYSE:BHP) and Antofagasta (LON:ANTO) over alleged environmental damage caused by their operations in the Atacama desert, draining the area’s aquifer by increased exploitation.

US EPA Denies 36 Refinery Biofuel Waivers. The US Environmental Protection Agency declined 36 exemption waivers coming from oil refiners for the 2018 compliance year, confirming a 2020 court decision that significantly narrowed the criteria on who could be eligible for blending exemptions.

Canada Approves $12 Billion Bay du Nord Project. The Canadian government approved the $12 billion offshore Bay du Nord project that would be operated by Equinor (NYSE:EQNR), having found no adverse environmental effects, marking the country’s first deep-water project that took years to greenlight.

European Tanker Firms Team Up in Giant Merger. Belgian oil tanker firm Euronav (EUAV) and Norwegian peer Frontline (FRO) agreed to merge in an all-stock transaction valued at $4.2 billion, creating a fleet of almost 150 active tankers of which 69 are VLCCs.

Shell Upgrades Russia Write-down Costs. UK energy major Shell (NYSE:SHEL) announced its decision to exit Russia will trigger a write-down of up to $5 billion in the first quarter of 2022, up some $1.5 billion from initial estimates on the back of unforeseen credit losses, write-downs of receivables and others.

Russian Refineries Start Overflowing with Surplus Products. The 150,000 b/d TAIF refinery located in the Volga region of Tatarstan was forced to shut down operations due to product overstocking as demand for Russian oil products fell amid Western sanctions, marking a new trend in Russia’s downstream industry.

US Jet Fuel Prices Shoot Through the Roof. Jet fuel prices on the US Atlantic Coast have soared to a record $7.6 per US gallon this week as the region suffers from depleted inventories coming on the back of lower imports and scant domestic availability of middle distillates, sending jet into wide backwardation.

Record Coal Production Cuts Chinese Import Need. With Chinese coal producers ramping up production in Q1, up 6-7% year-on-year, Beijing’s import requirements are gradually dwindling amid high outright prices, with most analysts expecting a drop of 40-50 million tons.

A Zinc Squeeze is Just Around the Corner. According to media reports, major commodity trading houses such as Trafigura are moving to take large amounts of zinc out of LME-approved warehouses in Asia (with stocks already having fallen 40% this year so far at 127,675mt), stoking fears of another metal squeeze looming.

Green Investors Ask Governments Not to Jeopardize Climate. Asset owners managing more than $10 trillion have urged governments not to ramp up fossil fuel usage as the world scrambles for supplies after the invasion of Ukraine, saying that energy supply diversification must hold a premium over security.

US Natgas Prices Nearing 2008 Record. With international demand for US LNG still robust, concerns of cooler weather coming have pushed front-month Henry Hub futures to $6.4 per mmBtu, putting the contract on track for its highest close since December 2008.

Record Saudi Prices Cool Indian and Chinese Interest. Following this week’s record price-setting from Saudi Aramco, media reports indicate that India and China will nominate less Saudi crude imports in May, with both continuing to purchase discounted Russian barrels as European buyers self-sanction from buying Urals.

By Tom Kool for Oilprice.com

Source:oilprice.com