By Gina Lee

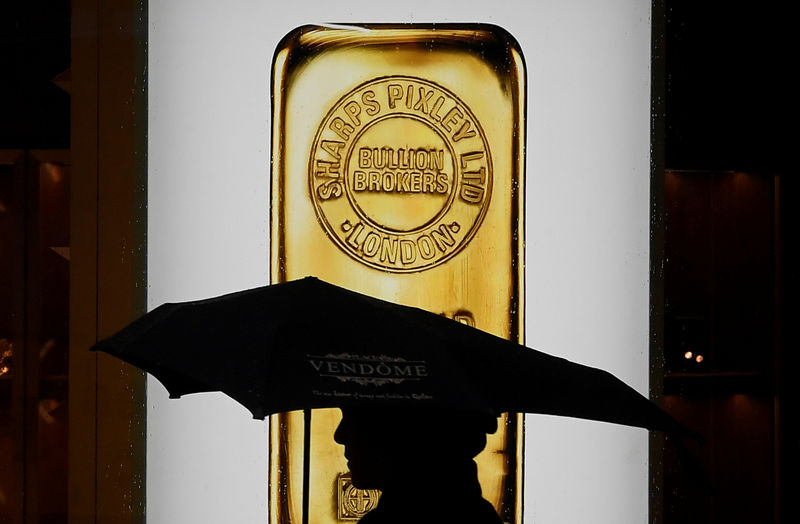

Investing.com – Gold was down on Wednesday morning in Asia, after gaining as much as 1% during the previous session, with investors digesting the latest U.S. inflation data.

Gold futures were down 0.26% to $1,970.90 by 12:46 AM ET (4:46 AM GMT), after hitting a near one-month peak of $1,978.21 on Tuesday. The dollar, which normally moves inversely to gold, inched down on Wednesday but remained near May 2020 highs.

U.S. Treasury yields inched down on Tuesday, with the benchmark 10-year Treasury yield set for its first fall in eight sessions.

Although data released on Tuesday showed the highest U.S. inflation since late 1981, there was a small glimmer of hope that price pressures may have peaked.

The data showed that the consumer price index (CPI) rose 8.5% year-on-year and 1.2% month-on-monthin March 2022. The core CPI rose 6.5% year-on-year and 0.3% month-on-month.

The war in Ukraine drove gasoline prices to record highs, making a strong case for the U.S. Federal Reserve to hike interest rates by 50 basis points in May 2022.

The war, precipitated by the Russian invasion of Ukraine on Feb. 24, shows no sign of ending and Russian President Vladimir Putin has also vowed to press on. The U.S. is also expected to send more weapons to Ukraine.

In Asia Pacific, the Reserve Bank of New Zealand hiked its interest rate to 1.5% as it handed down its policy decision earlier in the day, with the Bank of Canada following later in the day. The European Central Bank and the Bank of Korea will hand down their respective decisions on Thursday.

Holdings of the SPDR Gold Trust (P:GLD) were up 0.2% to 1,093.10 tons on Tuesday.

In other precious metals, silver was flat at $25.36 per ounce, while platinum was up 0.3% and palladium rose 1.1%.

Source : Investing.com