By Gina Lee

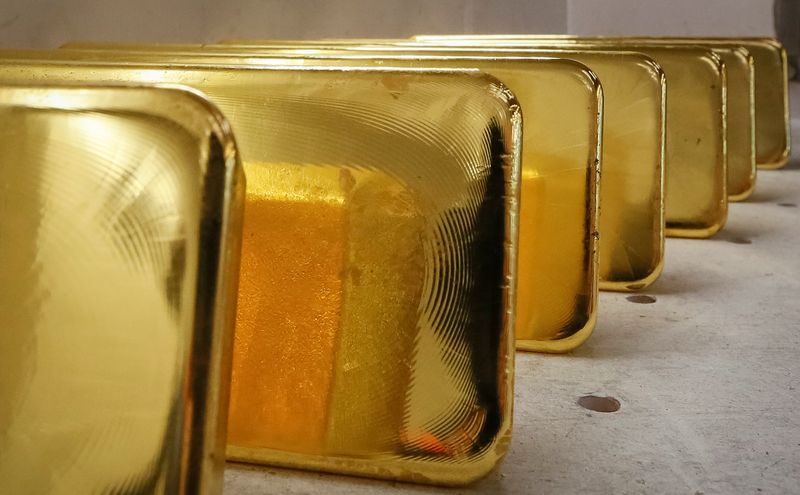

Investing.com – Gold was up on Tuesday morning in Asia, as U.S. Treasury yields hit multi-year highs. U.S. Federal Reserve Chairman Jerome Powell took a more hawkish stance on inflation, while the ongoing Ukraine conflict also gave the safe-haven asset a boost.

Gold futures were up 0.39% to $1,937 by 12:58 PM ET (4:58 AM GMT).

“There are no new inputs to materially move the price in Asia today, leaving gold stuck between higher U.S. yields and a ramp-up in risk-aversion sentiment,” OANDA senior analyst Jeffrey Halley told Reuters.

Powell warned that the Fed would raise interest rates by bigger-than-usual amounts if necessary to bring down “much too high” inflation.

European Central Bank President Christine Lagarde will speak at the BIS innovation summit later in the day. Bank of England Governor Andrew Bailey and Powell will speak a day later.

The yield on the benchmark 10-year U.S. Treasury note climbed above 2.3% for the first time since May 2019. A closely watched gap between rates for two- and 10-year Treasury notes flattened further, indicating a potential economic downturn.

Sharp (OTC:SHCAY) moves in the U.S. Treasury market are increasingly pointing to the risk of an approaching recession, with markets doubting the Fed’s plan to engineer a “soft landing” for the economy as it hikes interest rates to fight inflation, according to market experts.

However, the Ukraine conflict that has been going on since Russia’s invasion on Feb. 24 buffered the yellow metal’s fall. Ukraine said on Monday that it would not obey ultimatums from Russia to stop defending the city of Mariupol.

“The Ukraine conflict is likely to go on and increase supply-chain tensions and inflation pressures, supporting gold,” ABC Bullion global general manager Nicholas Frappell told Reuters.

Palladium, which is used by automakers in catalytic converters to curb emissions, fell 0.5%. Silver gained 0.5% and platinum was up 0.3%.

Source : Investing.com