By Gina Lee

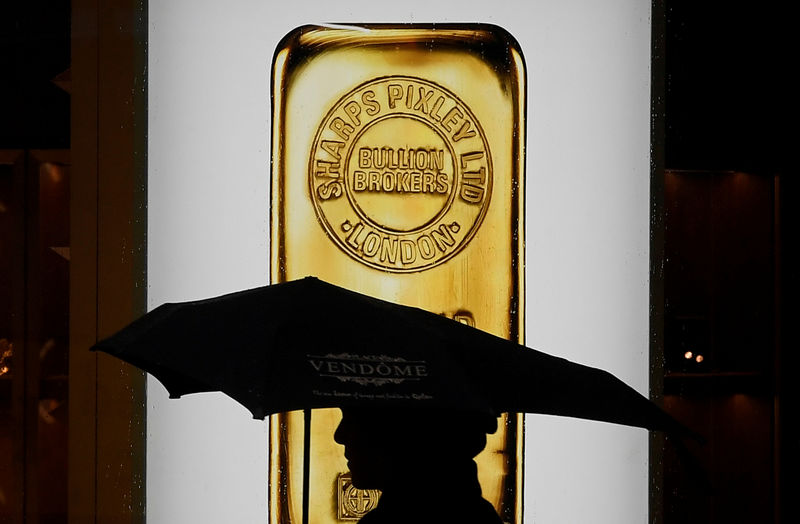

Investing.com – Gold was down on Wednesday morning in Asia as the U.S. dollar strengthens.

Gold futures was down 0.26% to $1,938.75 by 10:39 PM ET (3:39 AM GMT). The yellow metal rose about 6.5% in February, hitting an 18-month high of $1,973.96 last week. The dollar, which normally moves inversely to gold, inched up 0.04%.

Investors are flocking to safe-haven assets as Russia’s invasion of Ukraine intensified. Russia warned Kyiv residents to flee their homes, and Russian commanders have intensified the bombardment of Ukrainian cities.

The benchmark U.S. 10-year yield rose to 1.7548% from 1.711% late on Tuesday. Investors are concerned about aggressive interest rate hikes of the U.S. Federal Reserve in the next few months amid the Ukraine tensions and soaring inflation.

Investors also await Fed Chairman Jerome Powell’s testimony before the U.S. Congress on Wednesday and Thursday for more clues on interest rate hikes.

SPDR Gold Trust (P:GLD), holdings of the world’s largest gold-backed exchange-traded fund, rose 1.3% to 1,042.38 tones on Tuesday, the highest since July 2021.

In other precious metals. Palladium rose 1.2%, after hitting a seven-month peak of $2,722.79 on Tuesday. Russia is the biggest producer of palladium, with Moscow-based Nornickel accounting for 40% of the metal’s global mine production last year.

Silver fell 0.9%, while platinum was up 0.1%.

Source: Investing.com