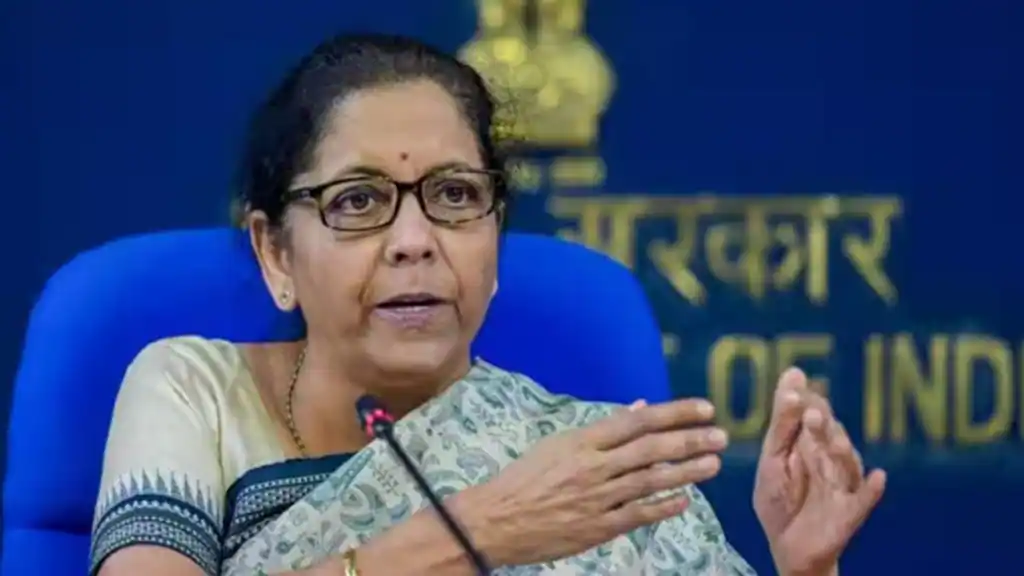

Even though India’s debt levels are not very high compared global average, the Central government is looking at ways to bring down the liabilities so as not to burden future generations, Finance Minister Nirmala Sitharaman said on Friday.

The minister’s statement assumes importance in the backdrop of constant flagging by global rating agencies that India’s general government (Centre and states) debt is higher compared to its peers and is a constraint to its potential rating upgrade.

“We are conscious of the debt of the Government of India today. Compared to many others it might not be as high as it is (said to be). But even there, we are consciously looking at experiments in different parts of the world,” Sitharaman said at the Kautilya Economic Conclave in New Delhi.

India’s general government debt which was around 70% in FY19 rose to around 88% in FY21 after Covid-19 broke out and the government mobilised more debt to provide succour as well as sustain economic activities. It has been brought down to around 81% in FY23 as the Centre and states rolled out fiscal consolidation plans. The Centre’s debt to GDP rose from around 49% in FY19 to 61.5% in FY21, before moderating to 57% in FY23.

Moody’s has projected India’s general government debt to stabilize at around 80% of GDP over the next two to three years, lower than the peak in FY21 but higher than many similarly-rated sovereigns.

How some of the emerging market countries are managing their debt, is something that is actively in the mind of the finance ministry, which is looking at ways to bring down the overall debt, Sitharaman said.

“We are, I am sure, going to be very successful in that because I have heard some very well-streamlined (ways) to meet India’s aspirational requirements but deal with it with a sense of responsibility so that our coming generations don’t feel the burden that the government has left them then,” she added.

The Centre’s fiscal deficit widened to 9.2% in the first year of Covid in FY21 as revenues were down like in many other countries. However, the fiscal deficit was brought down to 6.7% in FY22, 6.4% in FY23 and will be brought down to 5.9% in FY24. The medium-term target is to bring it down to 4.5% by FY26.

Sitharaman said the government was keen to adhere to the “bang for the buck argument”, which it did during the pandemic when it chose to invest heavily for asset creating infrastructure rather than heed calls to put more money in the hands of people.

Many advanced countries chose to put more money in the hands of people and are now suffering from higher inflation and growth slowdown.

“We dared not to do it… Some principles of economics stand the test of time. And that is when you spend money on capital expenditure and with a digitised approach, you are remaining transparent, people can see where that money is going, there are no kickbacks, the public spent money gets its return, and therefore you can stand up and tell to the next generation that we have been careful not to burden you,” she added.

According to IMF’s Fiscal Monitor report in April, public debt as a ratio to GDP has soared across the world during Covid-19. In 2020, the global average of this ratio approached 100%, and it is expected to remain above pre-pandemic levels for about half of the world, it said.

Source:financialexpress.com