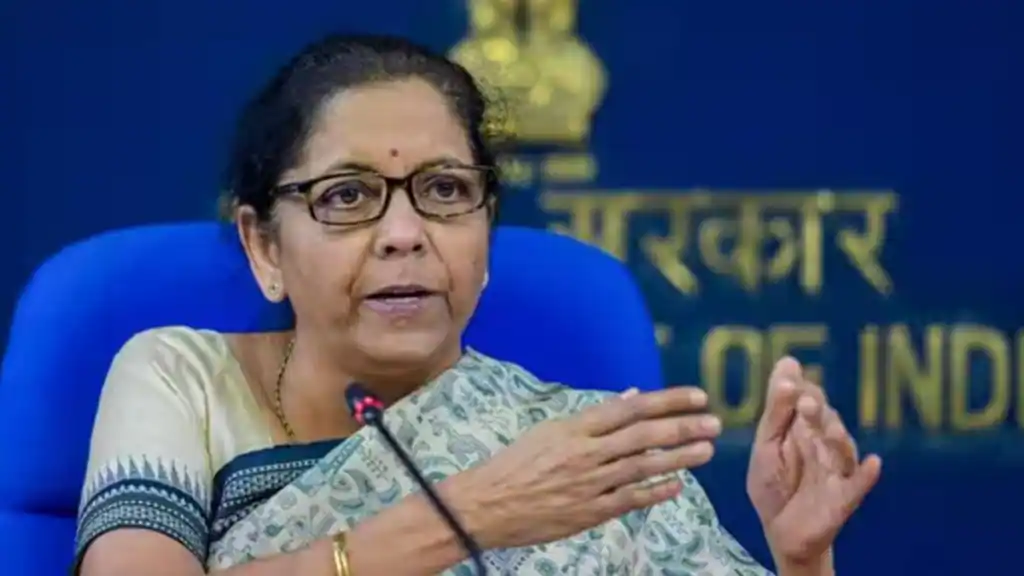

Sitharaman says Q1 GDP growth would be ‘good’

Central banks need to be cognizant of growth and growth-related priorities even while equally looking at curbing inflation, finance minister Nirmala Sitharaman said on Friday, while highlighting the unnecessary priority given to interest rates as a policy tool to curb inflation.

“Obsession with using interest rate as the only tool to deal with inflation, and not manage the supply side factors will not give a complete solution for inflation,” Sitharaman said at the B20 Summit 2023 organised by the CII in New Delhi

India’s headline consumer price index inflation spiked to 7.4% in July, with specific food commodities mainly driving the increase, sparking fears of rate hikes of prices not contained soon.

Ahead of the official release of the gross domestic product (GDP) on August 31, the FM said the growth in the first quarter of the current fiscal would be ‘good’. “The first quarter (Q1FY24) did go well, so the (GDP) numbers should be good,” Sitharaman said.

The RBI has estimated Q1FY24 real GDP growth at 7.8% and full FY24 growth at 6.5%. SBI economists have forecast that Q1FY24 GDP growth would be at 8.3%. S&P Global has said that India will be the fastest-growing economy in the G20.

Urging investors to take advantage of India’s sustained high economic growth, stable political and tax regime, Sitharaman said the government is looking at further liberalising foreign direct investment (FDI) and foreign portfolio investment (FPI) norms to attract more capital to sustain growth.

Recognising that FDI and FPIs are vital for India’s growth story, Sitharaman said “simplification and rationalisation of FPI regulations are going through reforms and increase in aggregate foreign investment limits are also being looked into”.

“We’ve looked at the introduction of a common application form for registration of FPIs and opening up of new channels of debt investments, like the voluntary retention route and fully accessible route. So, I think India stands as an attractive destination for FDI,” she added.

Despite economic global economic uncertainties, India attracted $70.97 billion in FDI in FY23 compared with $84.8 billion in FY22. Pitching India as the ultimate investment destination for manufacturing firms trying to diversify their supply chains amid the slowdown in China, Sitharaman said India has showcased an accelerated pace of economic reforms in the last nine years compared to sporadic reforms before that.

Explaining the capex-led economic growth model adopted by the government in recent years, Sitharaman said capital expenditure in total expenditure has gone up from 12.3% in FY18 to 22.4% in the FY24 Budget estimate. Further, the Centre has incentivised capex by states, which reported a 74% increase on year in Q1FY24. The Centre’s capex (including loans to states) grew by 59% on year in Q1FY24.

“This enhanced provision for capex by the government is now crowding in private investment. So, the green shoots of a private capex upcycle can be palpably felt by most of the observers,” the minister said.

The minister said India’s signing of FTAs with developed countries like the UK, Canada and EFTA countries (Switzerland, Norway, Iceland and Liechtenstein) will further boost India’s attractiveness to foreign investors.

“The speed with which negotiation is going on now certainly gives me hope that this year we should be able to conclude the agreement (with the UK),” Sitharaman said.

For sustainable global economic growth, the top priority should be to stem inflation as persistently high inflation will weaken demand and elevated interest rates for a considerable time can come in the way of economic recovery, she said.

The minister also expressed concern over the economic slowdown of China, the key global supply chain player. “ It’s a matter which all of us will have to be concerned,” she said, adding that global investors should take advantage of India’s skilled youth population, democracy and stable policies to make investments in the supply chain here.

On climate financing needs of emerging economies, including India, she said no country would be able to self-fund and global action is needed urgently to address the issue given that the developed countries have not delivered on the 2020 pledge of $100 billion. “For India, the transition period is going to be a challenge if we have to fund it all on our own resources,” she added.

Source:financialexpress.com