Risks are inherent to all financial sectors, and decentralized finance (DeFi) is no exception.

The most common forms of financial risk in traditional finance (TradFi) include credit risk, liquidity risk, asset-backed risk, foreign investment risk, equity risk, and currency risk.

While some of these risks may be present in DeFi, the industry largely has its own unique risks, and a recent report by digital asset investment firm CoinShares highlighted seven of them.

Volatility

First, crypto is extremely volatile and users need to consider this when evaluating their collateral or the value of a decentralized app (dapp)’s treasury. This explains why over-collateralization is a normal practice in DeFi.

It also explains why DeFi protocol Compound Treasury has received a credit rating of B- from major credit rating agency S&P Global Ratings. The agency cited the uncertain regulatory regime for stablecoins, stablecoin-to-fiat convertibility risks, and the Treasury’s “limited capital base” along with a 4% per annum return obligation as reasons for the decision.

Smart contract bugs

A smart contract is a self-executing contract with prespecified terms and conditions. It executes a program exactly as written but that does not guarantee its safety. Errors in smart contracts can prove to be detrimental particularly since the blockchain is immutable, meaning that these errors cannot be easily rectified.

“As long as humans remain imperfect, so will the code they write,” the report said, adding that there is an even greater risk with newer dapps.

The ponzinomics potential

As of now, the bulk majority of “DeFi tokens offer no true value accrual mechanisms” aside from voting power. This could tempt protocols “to opt for more ponzinomics to attract users and increase (temporarily) the price of its tokens,” the report said, noting that this could be the third risk associated with DeFi.

Mercenaries

The fourth risk that can come with DeFi is liquidity providers leaving projects after taking advantage of the short-term incentive programs used to attract liquidity – also known as ‘mercenaries’. While certain tokenomics can help create access to more robust liquidity, more experimentation needs to be done and users need to exercise extra caution.

Losing the peg

De-pegging from algorithmic failure or loss of belief in reserve assets of stablecoins may also prove to be a systemic risk. In fact, there have been several examples of algorithmic stablecoins losing their intended peg, as evidenced by Iron Finance, Empty Set Dollar, Dynamic Set Dollar, Basis Cash, and of course, TerraUSD.

The governance dangers

Another DeFi risk comes from governance.

“Governance is not an easy endeavour, especially in a decentralised setting,” the report said.

The authors further added that the current “1 token 1 vote” system actually leads to voter apathy, as well as to higher chances of plutocracy. “Short-sighted governance can also lead to tokenomics that distribute wealth to those in control in an unsustainable manner.”

The eternally looming regulations

CoinShares pointed to the uncertainty of regulations, which remain like a sword hanging over the head of DeFi. Several countries like China and Egypt have taken harsh stances with regard to crypto, announcing bans. Others, meanwhile, have banned participation in types of fundraising or airdrops.

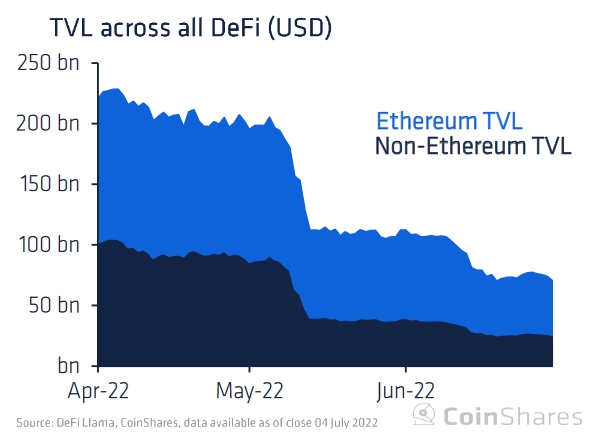

Bear market leads to massive TVL drop

Meanwhile, the report also noted that 2022 has been a negative year for DeFi and crypto so far. Total Value Locked (TVL) across DeFi decreased 70% in the last quarter alone to USD 70 billion, but it’s mostly due to the sharp drop in token prices. The TVL deposits have been “somewhat flat” since the start of the quarter and remain close to all-time highs, the report noted.

Moreover, the average “blue-chip” DeFi token is currently down by 90% compared to its May peak with some experiencing even greater drawdowns.

Per DeFi Llama, the TVL currently sits at USD 73.76bn.

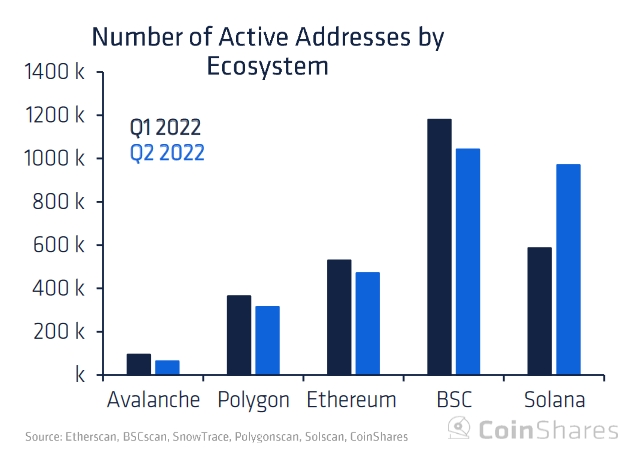

The average number of unique addresses declined in the major blockchains observed by CoinShares, except Solana (SOL), which they said saw users rise by an average of 84,000 during Q2 2022.

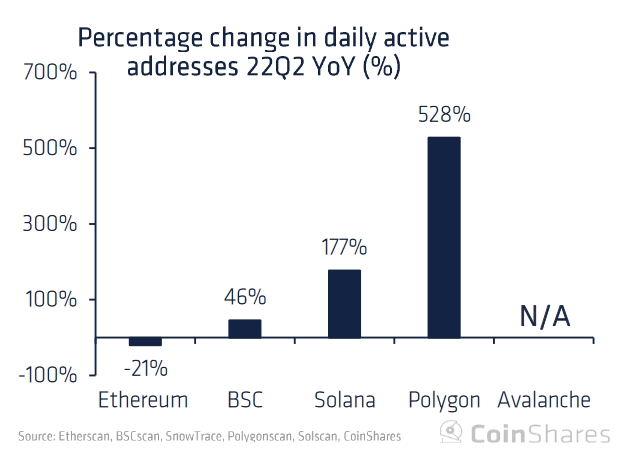

“Despite the fall in users during the ninety-day period, daily active addresses are still materially up year over year,” said CoinShares.

Looking at the yearly change in DAW (Daily Active Wallets), Polygon (MATIC) showed the largest percentage uptake of over 500% (250,000 users onboarded), while Ethereum (ETH)’s decline in user growth “may be attributed to increased competition among the top smart contract platforms.”

Source: CoinShares

Source:cryptonews.com