On Wednesday, the US Federal Reserve (Fed) raised rates by 75 basis points, in line with most analysts’ forecasts. Cryptoassets mostly reacted by trading higher in the first hour after the news was announced.

“[…] the Committee decided to raise the target range for the federal funds rate to 1‑1/2 to 1-3/4 percent and anticipates that ongoing increases in the target range will be appropriate,” the statement from the Fed said.

Bitcoin (BTC) reacted to the news by immediately trading lower in the market, before later reversing to the upside. 1 hour into the announcement, the number one cryptocurrency had risen 2% to USD 21,560. At the same time, ethereum (ETH) traded up by a much stronger 6% to USD 1,180. Stocks reacted in a similar way, with the broad S&P 500 index rising by 0.17% in the first hour following the announcement.

The rate hike is higher than the 50-basis point hike Fed officials have previously indicated they would go for, but in line with what most market participants estimated after a higher-than-expected inflation report was released last week.

Powell has in a previous interview with the Wall Street Journal said that if the central bank does not see “clear and convincing evidence that inflation pressures are abating,” it will “consider moving more aggressively.”

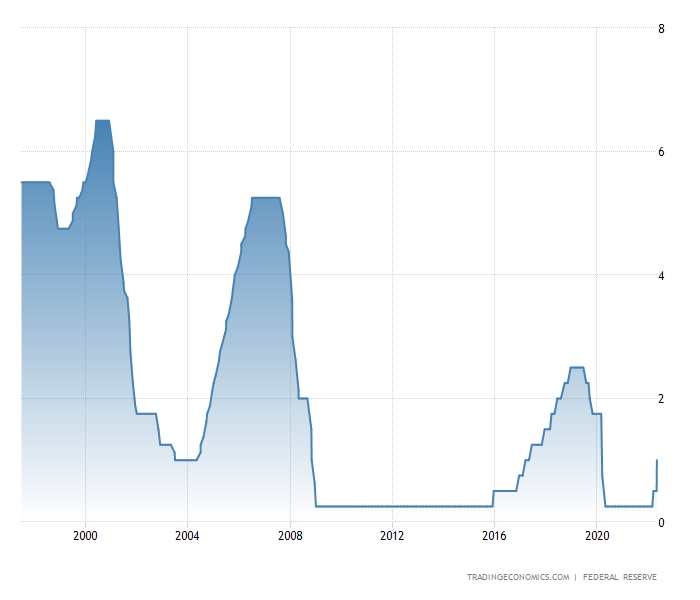

At its last meeting in May, the Fed raised rates by 50-basis points. The increase then marked the first such increase since 2000. 75-basis point hikes are even rarer, and have not happened since November 1994 when then-Fed chair Alan Greenspan was seeking to combat rising inflation.

Federal Funds rate ahead of Wednesday’s hike:

Commenting ahead of today’s Fed announcement, crypto broker GlobalBlock analyst Marcus Sotiriou said that an aggressive Fed – contrary to conventional wisdom – could be the best outcome for markets today.

“I think a very aggressive Federal Reserve might be the best way forward for markets, so that the Federal Reserve will be able to resume [quantitative easing] sooner,” Sotiriou said in an emailed comment.

He added that quantitative easing (QE) by the Fed is what has fueled the rise in both crypto and other risk assets in recent years, and that a tightening from the Fed means investors “are forced to unwind their positions,” inevitably leading to lower prices.

“Investors can’t realistically expect risk assets to have a more sustained uptrend until the Fed pivots,” Mikkel Morch, Executive Director at crypto/digital asset hedge fund ARK36, said in an emailed comment, adding that bitcoin (BTC) “has been really caught in the crossfire these past few days.”

According to him, there is still a huge gap between nominal rates and real rates so there is much more room for the Fed and other central banks to hike in the months to come.

“So bitcoin is hit with a double whammy and it is more than likely that we are going to see sub-[USD 20,000] prices soon,” Morch said, adding that calls for USD 12,000 per BTC have “a relatively low probability for now.”

Meanwhile, asset manager DoubleLine Capital CEO Jeffrey Gundlach, known as the Bond King, suggested the Fed should be even more aggressive, saying on Twitter that 3% would, in his opinion, be an appropriate level for the Fed Funds rate.

Ahead of today’s hike, the Fed Funds rate stood at 0.75% to 1%.

Also pushing for aggressive action was Mohamed A. El-Erian, a well-known economist and President of Cambridge University’s Queen’s College, who wrote in a Bloomberg opinion piece that the Fed “desperately needs to regain control of the inflation narrative.”

The Fed’s failure to do so risks turning its reputation to something that resembles “an emerging market bank that lacks credibility and inadvertently contributes to undue financial volatility,” El-Erian wrote.

Also commenting ahead of the hike, Peter Brandt, a veteran trader, said the Fed has “never in modern Fed history been so far behind the curve.”

“Solution: Fed rate hike by 400 [basis points], let stock market collapse and then hit the reset button,” Brandt suggested to his more than 600,000 Twitter followers.

ECB addresses market turmoil

The move by the Fed came on the same day as the European Central Bank’s (ECB) Governing Council gathered for an emergency meeting to address the turmoil in the market for European government bonds.

According to a statement from the ECB after the meeting, the central bank will now “apply flexibility” when it comes to reinvesting proceeds from its pandemic-era bond-buying program.

It added that it will accelerate work on the design of a new “anti-fragmentation instrument” that will be put up for consideration by the Governing Council. The statement did not specify what such an anti-fragmentation instrument could look like.

“Anti-fragmentation” refers to work the ECB does to prevent differences in market conditions for government bonds across the eurozone from getting too large.

Source:cryptonews.com