There’s no better proof of Twitter’s impact on public conversation and markets than one tweet moving billions of dollars in market cap across three different companies in a matter of minutes.

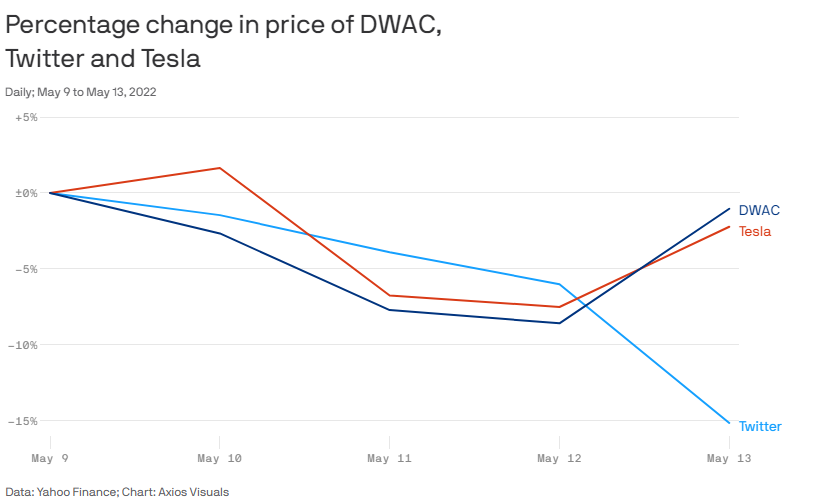

Driving the news: Elon Musk’s tweet that his pending Twitter takeover deal was “temporarily on hold” sent Wall Street on a wild ride Friday. Investors were already beginning to grow skeptical of Musk’s bid, but the possibility that he could walk sent Twitter’s shares tumbling more than 20% before the market opened.

- Musk’s tweeted clarification two hours later that he was still “committed” to the acquisition gave the stock a pop, but shares still closed down nearly 10% at market close.

Be smart: Musk’s tweet set off a ripple effect across a slew of companies, including Tesla, which saw shares jump nearly 6% on the possibility that Musk wouldn’t become a part-time CEO.

- Shares in DWAC, the blank check company that plans to take former President Trump’s social media company Truth Social, also gained on the possibility that Elon might bail on the deal.

Source:axios.com