By Gina Lee

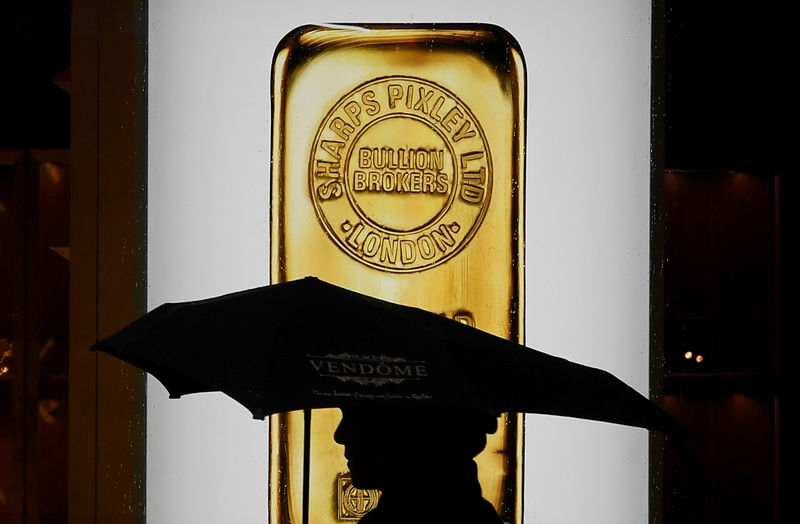

Investing.com – Gold was down on Wednesday morning in Asia, holding near a two-week low. Investors stayed away from big bets as they await the U.S. Federal Reserve’s latest policy decision.

Gold futures fell 0.59% to $1,918.30 by 1:04 PM ET (5:04 AM GMT). The yellow metal remained little changed after hitting its lowest since Mar. 1, or $1,906, during the previous session.

U.S. Treasury yields climbed to their highest level in more than two-and-a-half years on Tuesday, ahead of the Fed’s policy decision to be handed down later in the day. The Fed is widely expected to hike interest rates.

Across the Atlantic, the Bank of England will hand down its policy decision on Thursday. European Central Bank President Christine Lagarde, Executive Board member Isabel Schnabel, Governing Council member Ignazio Visco, and Chief Economist Philip Lane will speak at a conference on the same day.

The Bank of Japan will hand down its own policy decision a day later.

U.S. President Joe Biden will head to Europe in the following week, his first visit since Russia’s invasion of Ukraine on Feb. 24. He will discuss the crisis in Ukraine with NATO allies during the visit, the White House said on Tuesday.

Meanwhile, the number of Ukrainian refugees hit 3 million as Russia continues its air strikes.

The Central Bank of the Russian Federation (the Bank of Russia) also said it would suspend purchases of gold from banks from Tuesday to meet increased demand from households. This is the central bank’s latest attempt to deal with the impact of Western sanctions on Russia.

Holdings of SPDR Gold Trust (P:GLD) fell 0.2% to 1,061.8 tons on Tuesday.

In other precious metals, palladium gained 0.5%, but remained near a more than two-week low hit on Monday, as supply fears eased. Silver edged up 0.2% and platinum inched up 0.1%.

Source : Investing.com